Running Autonomous AI Agents with Curupira

How Curupira orchestrates autonomous AI trading agents — from research to execution. Architecture overview, agent lifecycle, monitoring, and how to build your own agent on the platform.

Estratégias quantitativas de trading, agentes de IA e a infraestrutura por trás de tudo. 100% open source.

How Curupira orchestrates autonomous AI trading agents — from research to execution. Architecture overview, agent lifecycle, monitoring, and how to build your own agent on the platform.

Why treating financial markets as natural language problems — not physics problems — yields better predictive models. The theoretical framework behind our AI trading approach, inspired by Renaissance Technologies and modern NLP.

How to use on-chain perpetual futures data — funding rates, open interest, and liquidation heatmaps — as quantitative trading signals. Python implementations and backtest results on crypto markets.

How we built an autonomous LLM-powered trading agent that runs on Hyperliquid for $1.30/day in API costs. Complete architecture, cost breakdown, prompt engineering, and live results.

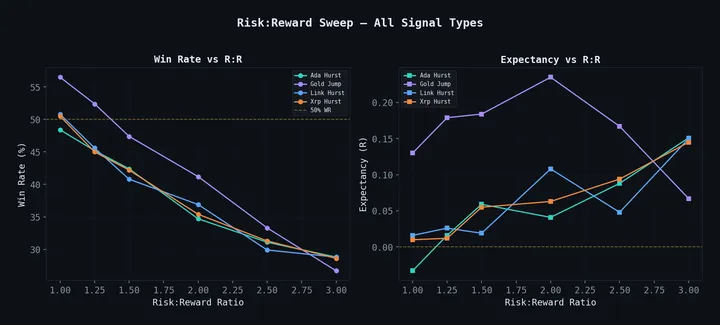

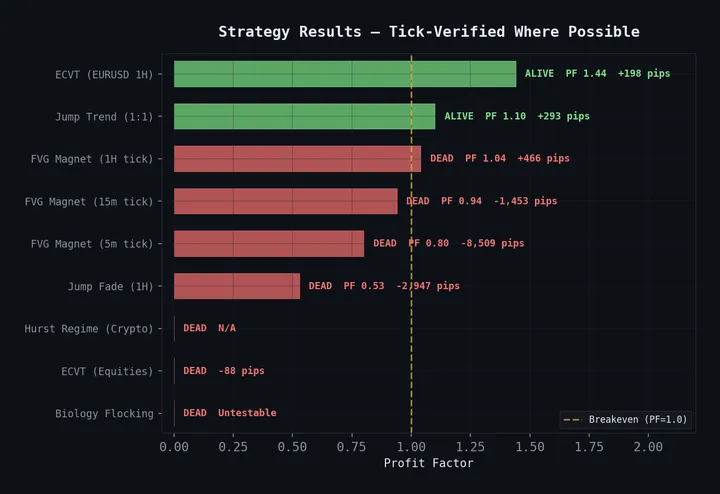

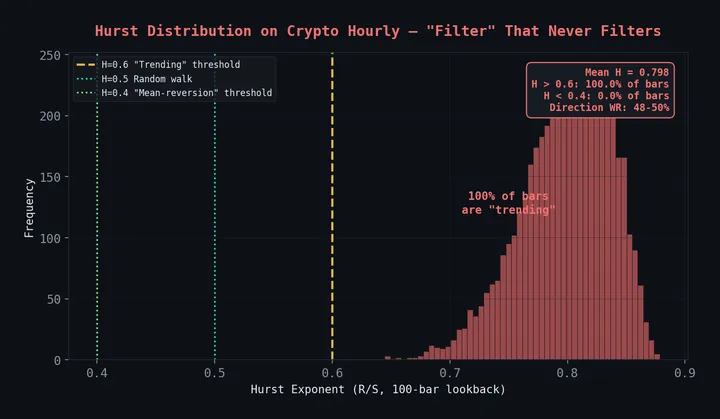

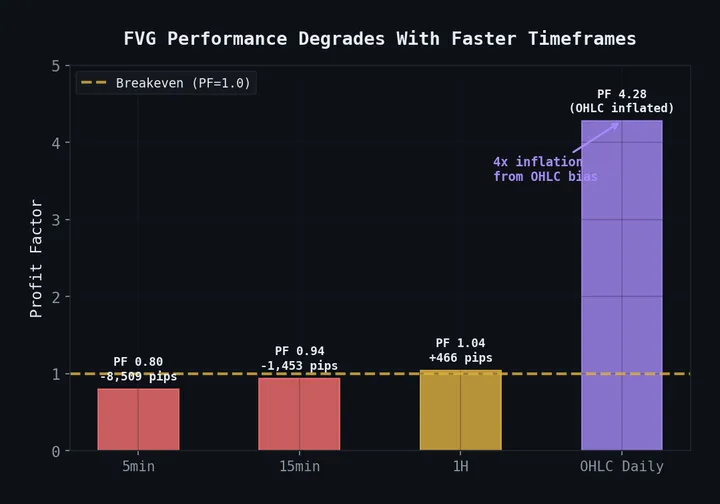

The complete results of testing 31 systematic trading strategies across forex and crypto. What worked, what failed, and the patterns that separate robust strategies from curve-fitted illusions.

Using the Hurst exponent to dynamically identify mean-reverting vs. trending regimes in forex markets. Complete theory, Python implementation, and backtest results for a regime-adaptive trading system.

A rigorous statistical analysis of fair value gap magnetism in price action trading. We test the claim that FVGs act as magnets for price, introduce the FVG Wall specification, and present backtest results across forex and crypto markets.

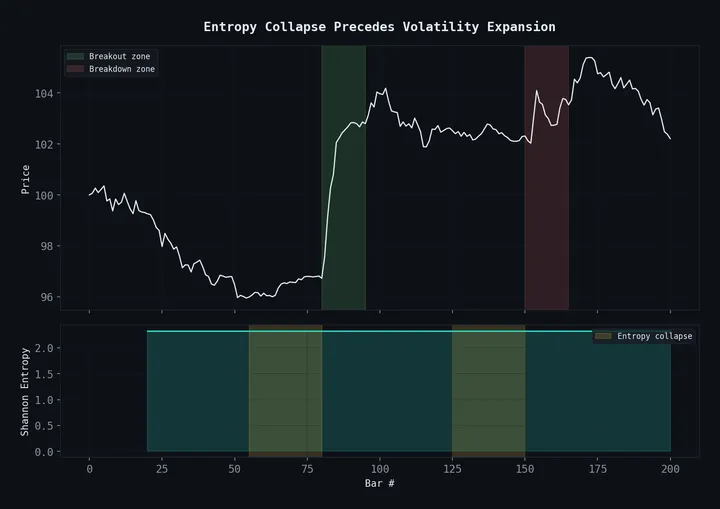

How we use Shannon entropy of price returns to detect volatility regime changes before they happen. Full methodology, Python implementation, and backtest results showing a 1.44 profit factor on EURUSD.

The Curupira manifesto — why we believe open-sourcing quantitative trading research is the future of retail alpha generation, and how radical transparency makes us better traders.