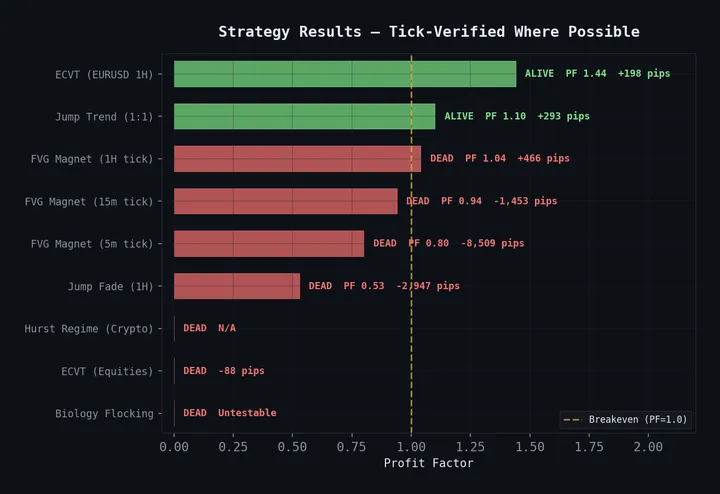

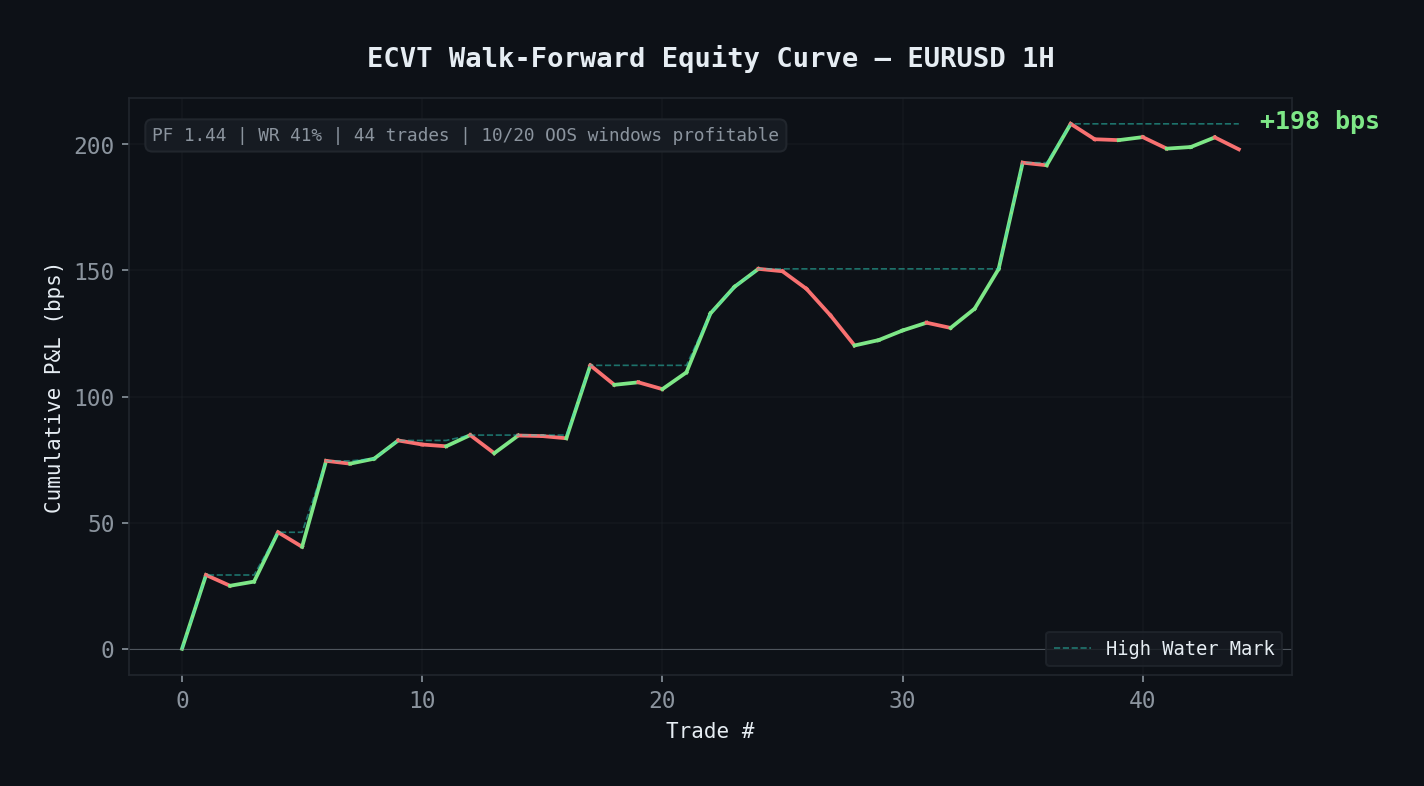

31 Strategies Tested, 4 Survived

The complete results of testing 31 systematic trading strategies across forex and crypto. What worked, what failed, and the patterns that separate robust strategies from curve-fitted illusions.

We hunt scientific papers nobody thinks to apply to markets, build systematic strategies from them, then kill them honestly with tick-level backtesting. Here's what's left standing.

Tick-verified where possible. Walk-forward validated. 42M ticks of EURUSD.

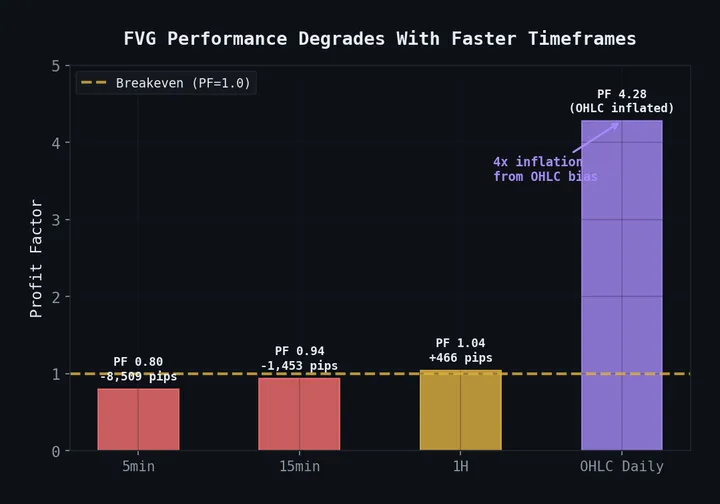

FVG showed PF 4.28 on OHLC daily. Tick verification: PF 1.04. Close-based SL/TP inflates results by 4×. Always verify with tick data.

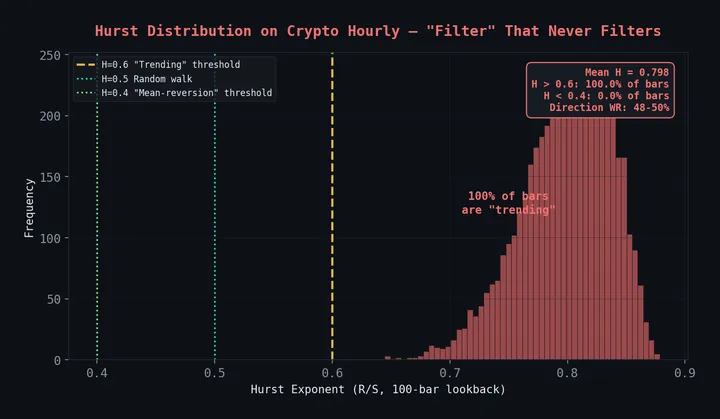

Hurst > 0.6 fires on 100% of crypto hourly bars. A signal that's always "on" has zero information content. Profile thresholds before backtesting.

Jump fade + trend = -3000 pips. Trend alone = +293 pips (55% WR). Composite signals can hide working components.

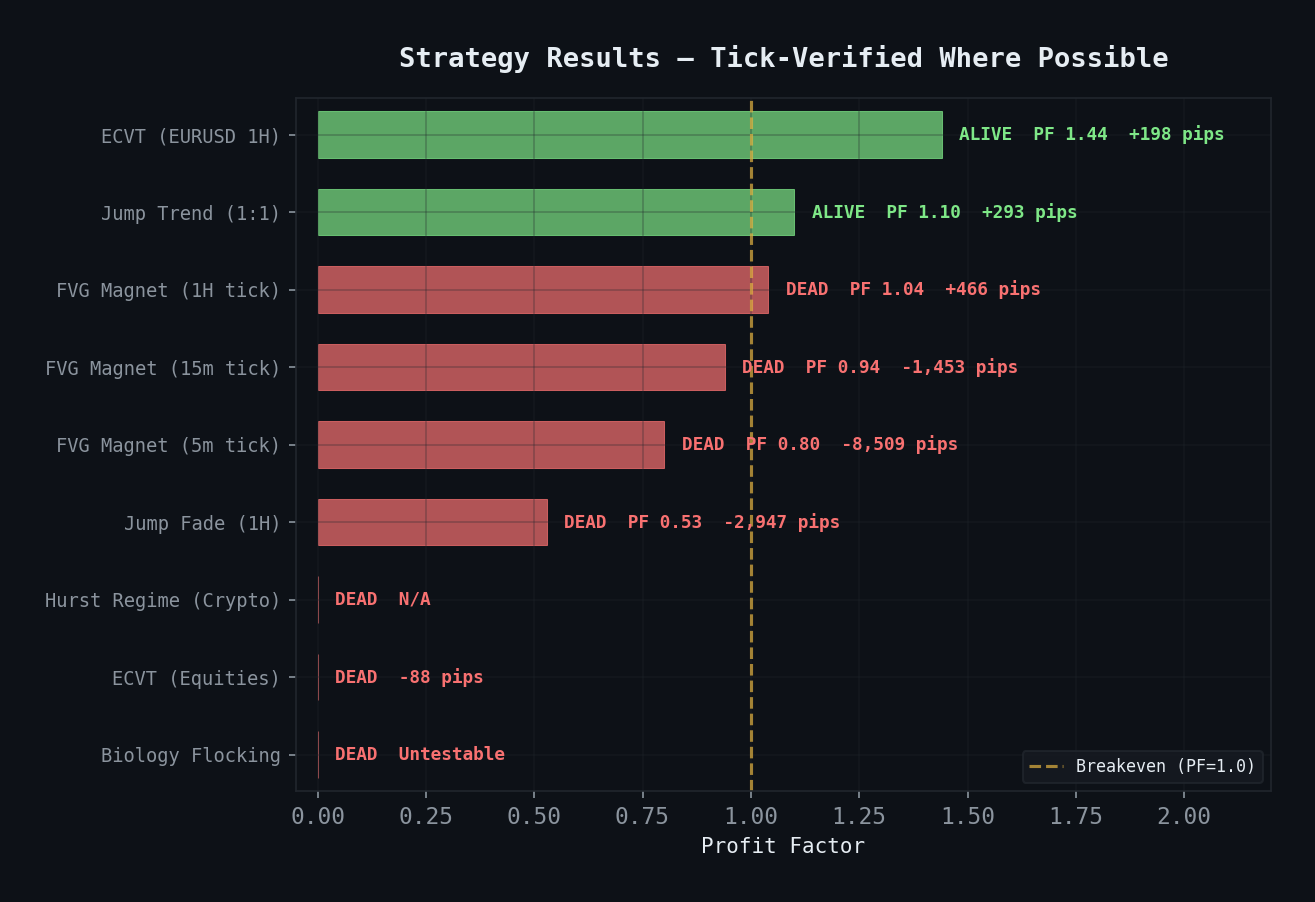

ECVT: +198 bps on EURUSD hourly, 0-9 signals on equities. Jump: works on Gold daily, pure noise on forex hourly. Always validate per market.

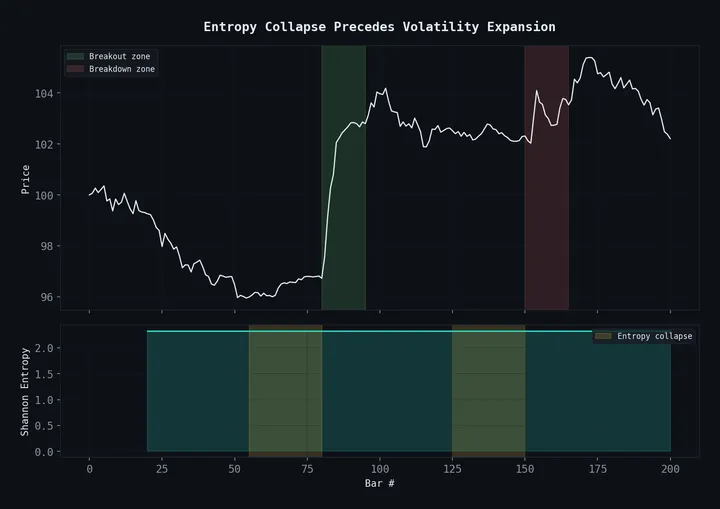

Based on Singha 2025. Entropy collapse predicts volatility magnitude — we adapted it from tick-level trade data to hourly returns.

The complete results of testing 31 systematic trading strategies across forex and crypto. What worked, what failed, and the patterns that separate robust strategies from curve-fitted illusions.

Using the Hurst exponent to dynamically identify mean-reverting vs. trending regimes in forex markets. Complete theory, Python implementation, and backtest results for a regime-adaptive trading system.

A rigorous statistical analysis of fair value gap magnetism in price action trading. We test the claim that FVGs act as magnets for price, introduce the FVG Wall specification, and present backtest results across forex and crypto markets.

How we use Shannon entropy of price returns to detect volatility regime changes before they happen. Full methodology, Python implementation, and backtest results showing a 1.44 profit factor on EURUSD.

Every strategy, every backtest, every signal — fully open source on GitHub.

View Repository