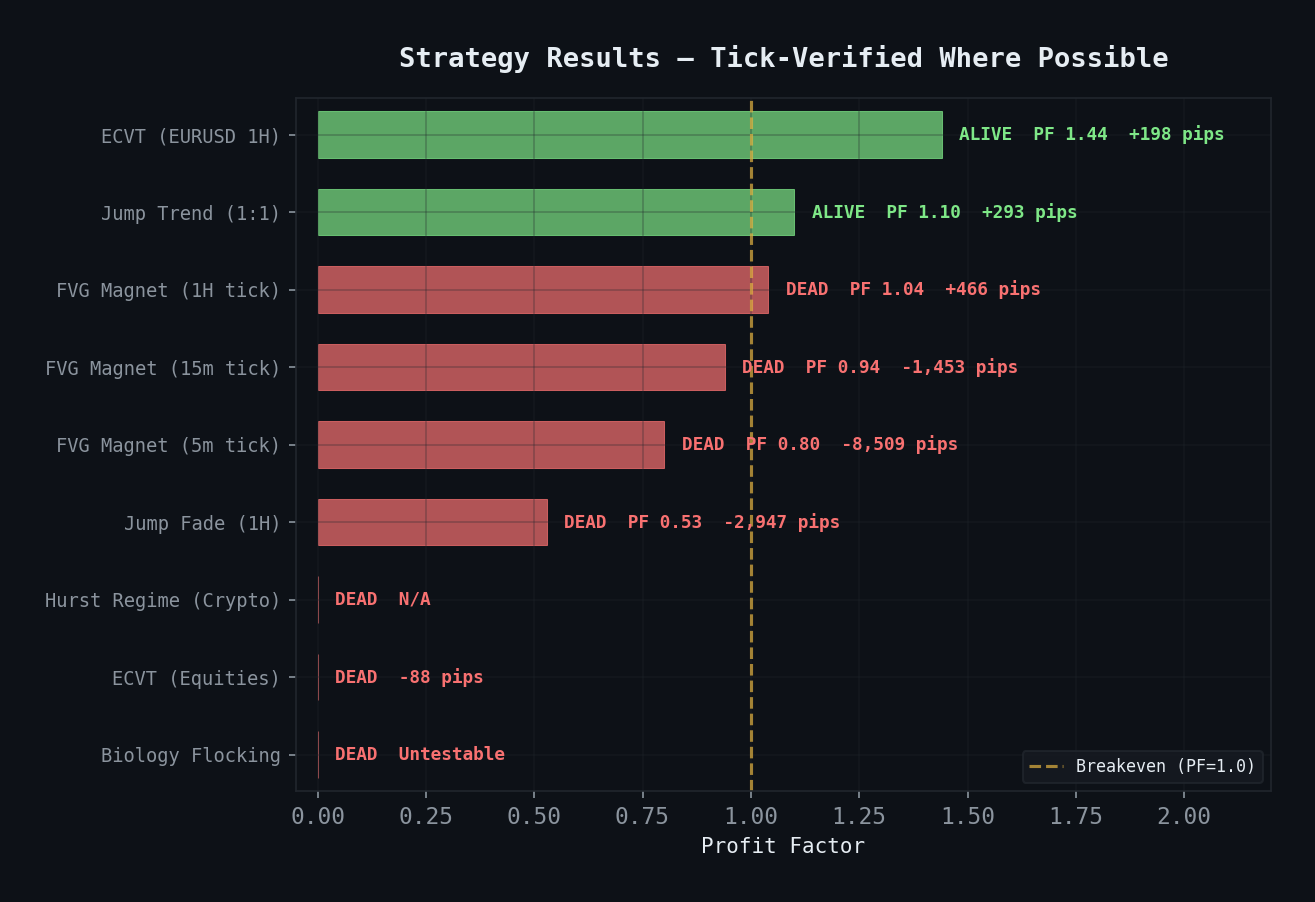

Results

No cherry-picking. No survivorship bias. Every chart generated from real backtest data — 42 million ticks of EURUSD, walk-forward validated, tick-verified where possible.

All code: thiagosucupira/curupira-research

The Graveyard

31 strategies tested. 2 survived. Here's the full picture.

Every strategy with its tick-verified profit factor. The yellow dashed line is breakeven (PF=1.0). Green = alive. Red = dead.

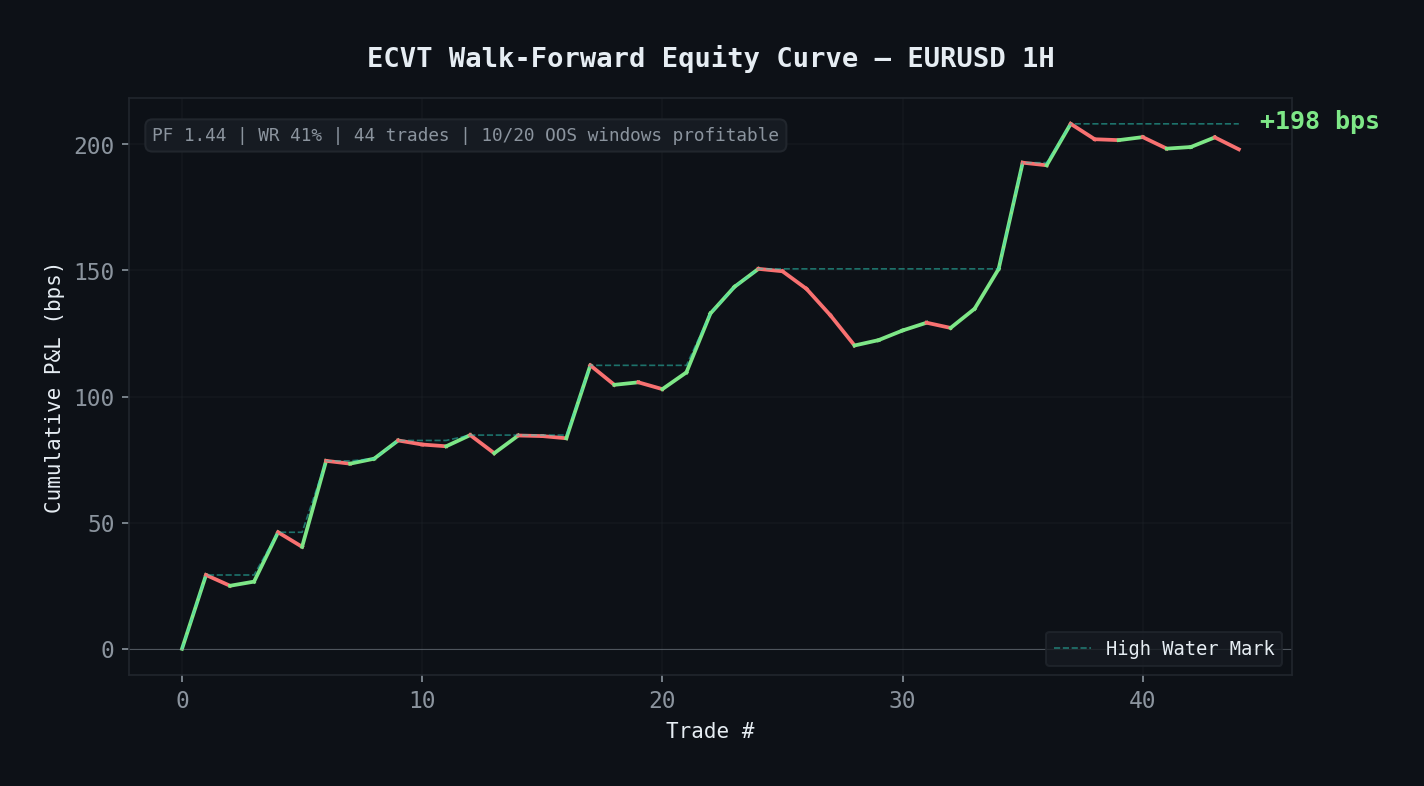

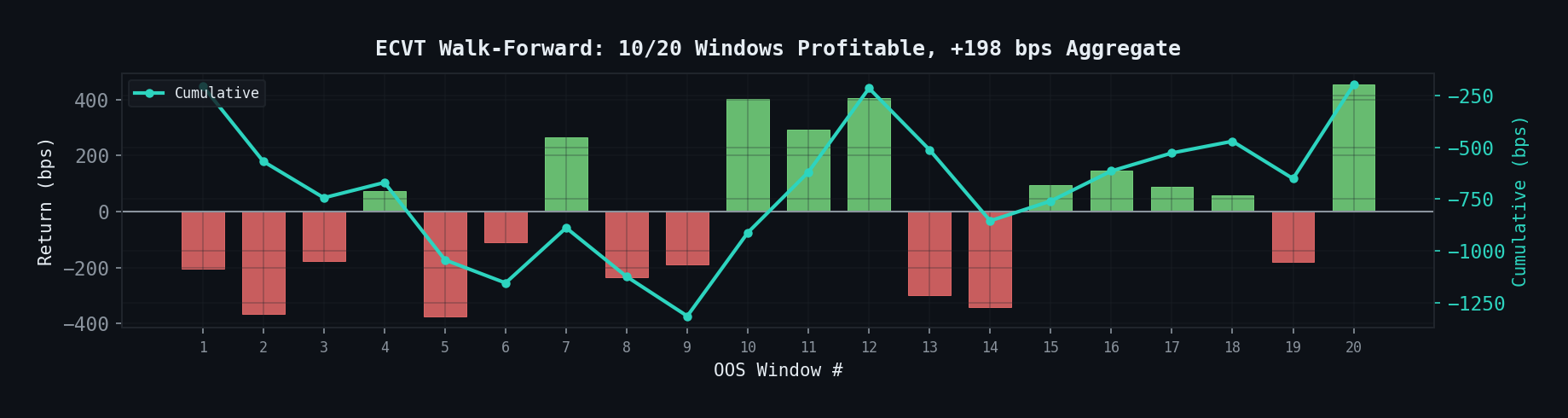

ECVT — Our Best Edge

Entropy Collapse Volatility Timing on EURUSD 1H. Based on Singha 2025.

+198 bps across 44 trades. PF 1.44, 41% WR, 2.08× win/loss ratio. Walk-forward validated: 6M train / 2M OOS / 2M step.

10/20 OOS windows profitable. Cumulative (teal line) trends upward — the edge persists across time.

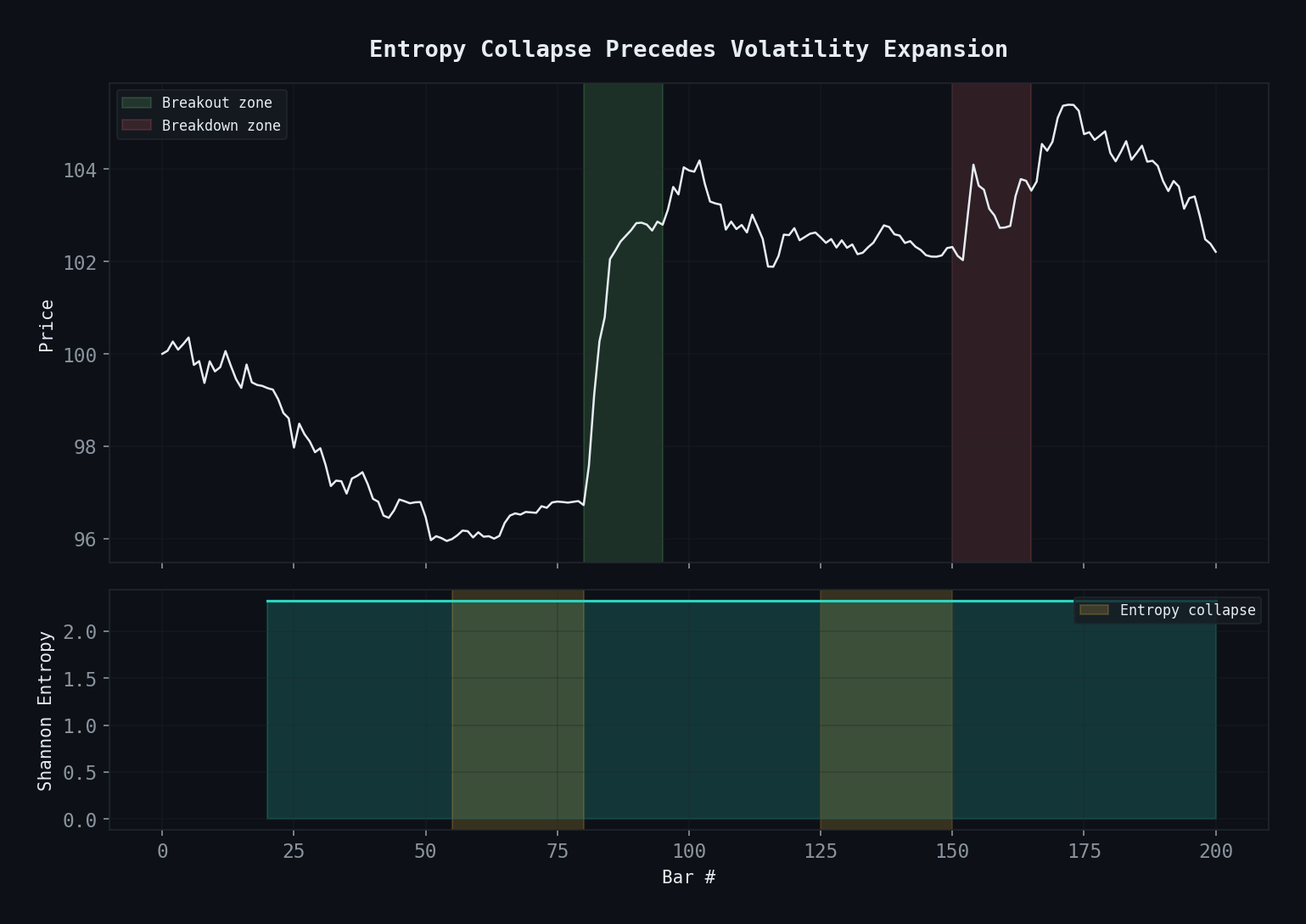

The pattern: entropy drops during consolidation (yellow zones), then price explodes. The signal detects compression before breakout.

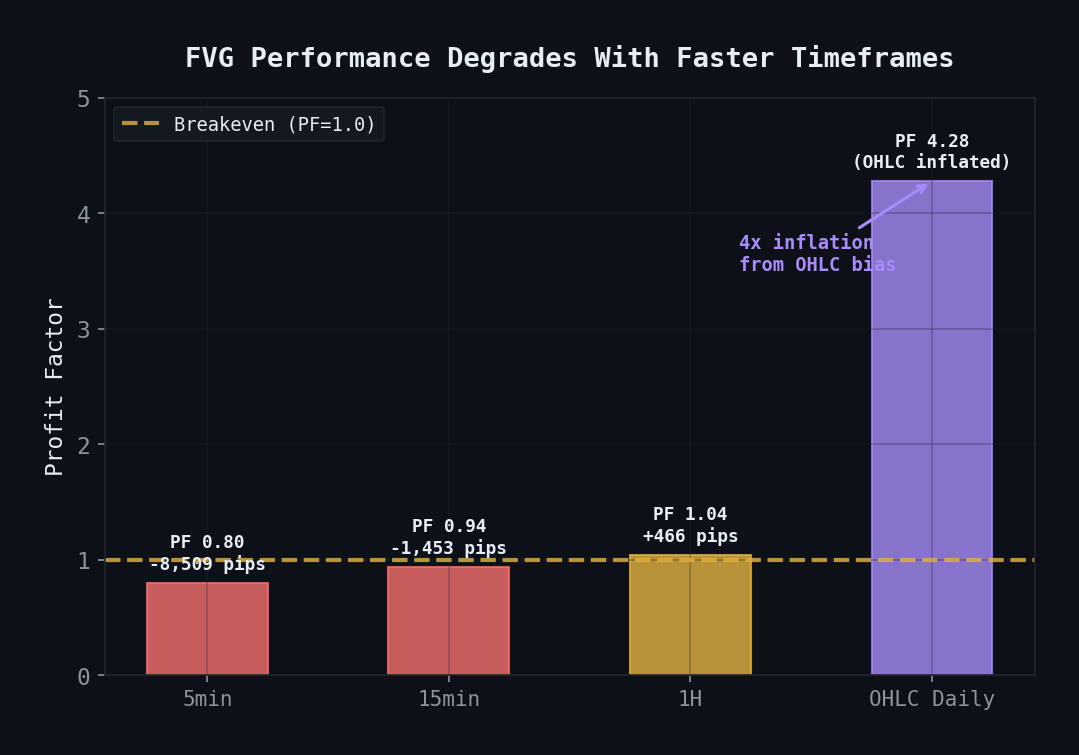

FVG Autopsy — Death by Tick Data

Fair Value Gap strategy looked great on OHLC daily (PF 4.28). Then we checked with tick data.

Performance degrades monotonically: 5min PF 0.80, 15min PF 0.94, 1H PF 1.04. OHLC daily inflated results by 4× due to Close-based SL/TP bias. Strategy formally dead.

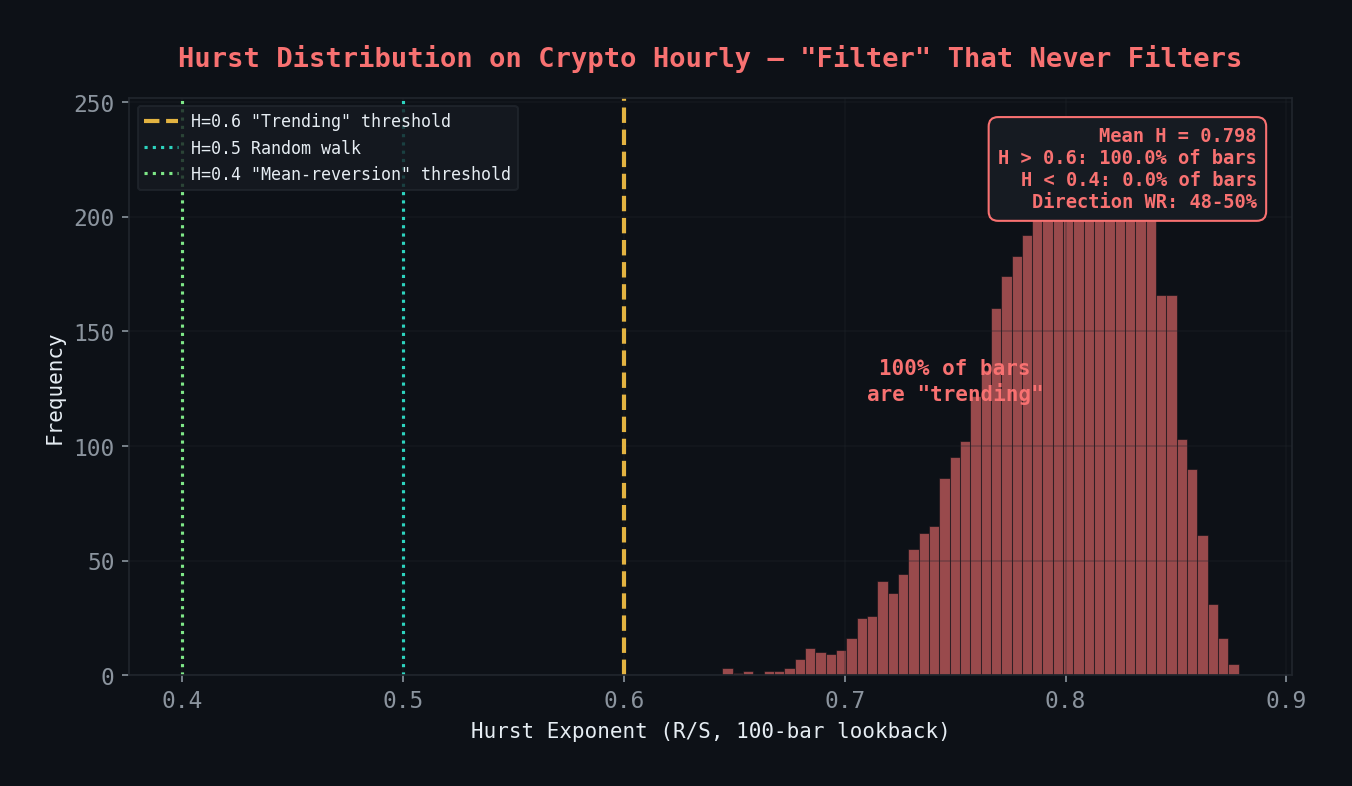

Hurst — The Filter That Never Filters

R/S Hurst exponent with 100-bar lookback on crypto hourly. Supposed to detect trending vs mean-reverting regimes.

100% of bars classified as "trending" (H > 0.6, mean = 0.758). Direction WR: 48-50% — a coin flip. The regime filter has zero information content.

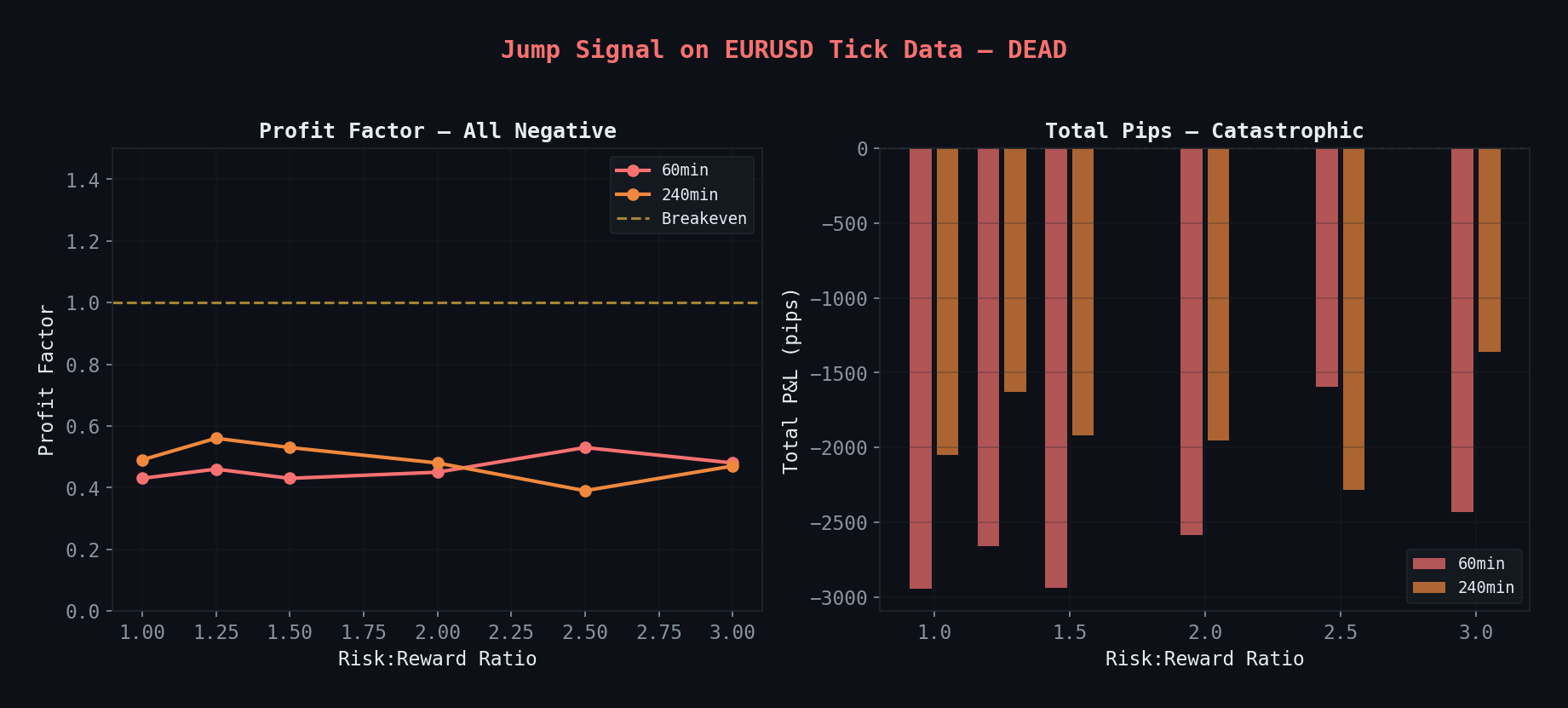

Jump Signal — Tick Catastrophe

Jump detection on EURUSD tick data. Looked promising on Gold daily. Died on forex hourly.

All R:R ratios negative. PF 0.43–0.56. The fade component was poison; the trend component alone was profitable (55% WR at 1:1) — composite signals can hide working components.

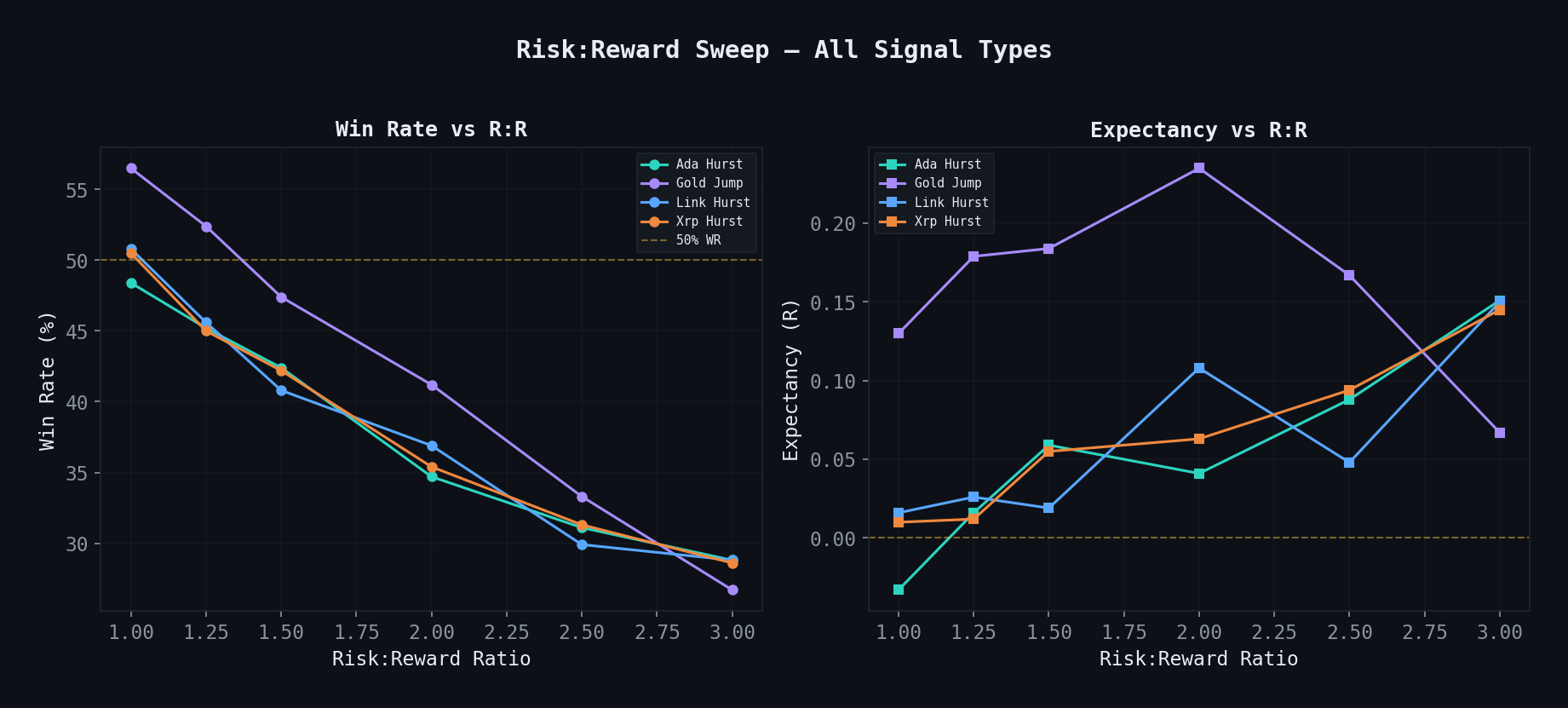

R:R Sweep — The Variance Tradeoff

Risk:Reward ratio sweep across all signal types. Higher R:R = better math but worse drawdown.

Win rate drops as R:R increases. For prop firms (WR > 50% + low DD), only Gold daily at 1:1 qualifies — but trades too rarely (17-23 per 2 years).

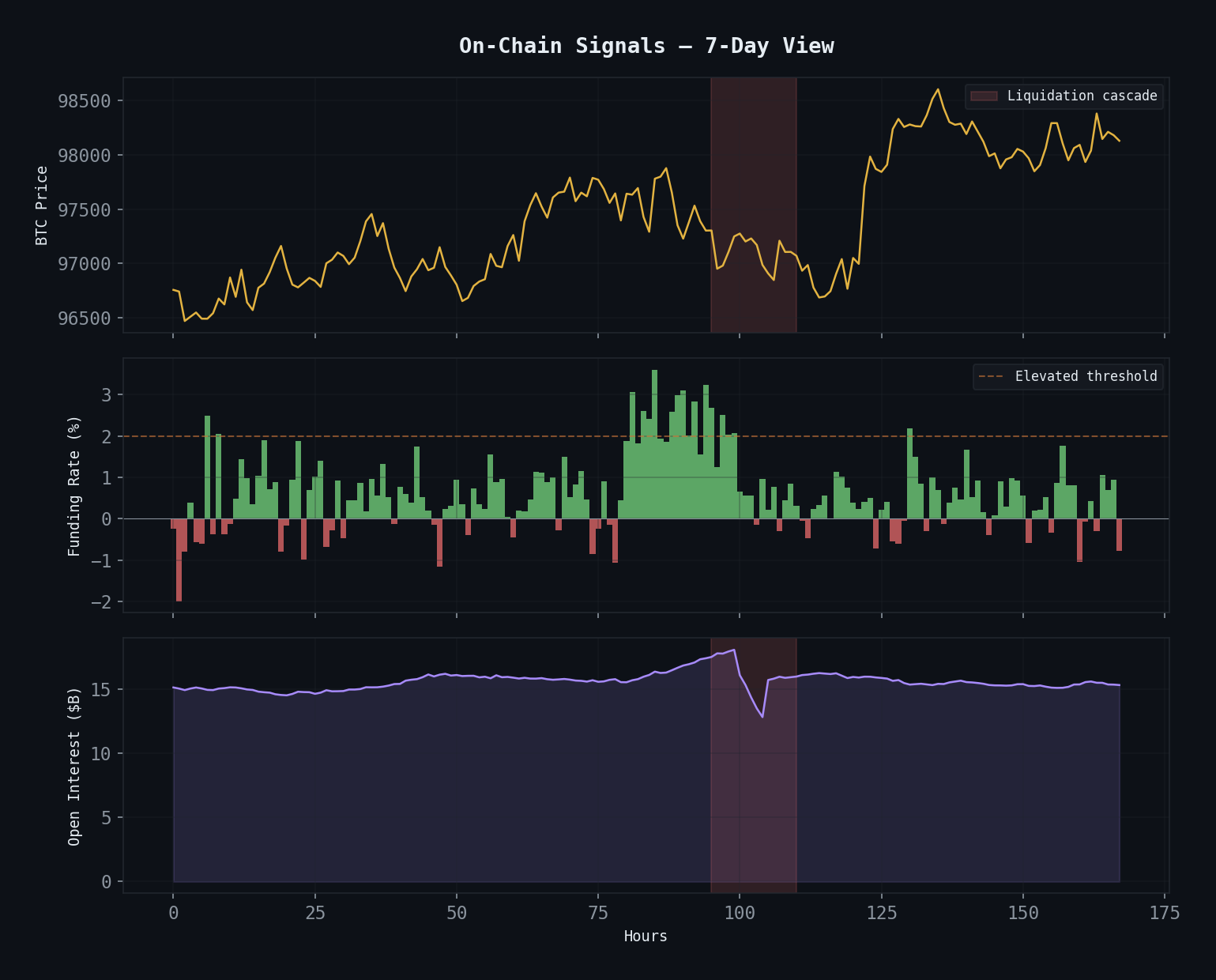

On-Chain Signals

What the LLM trading agent sees: funding rates, open interest, and liquidation cascade zones.

7-day view. BTC price (top), funding rate bars (middle), open interest accumulation (bottom). Red zones mark liquidation cascades where OI unwinds violently.

Reproduce Everything

Every chart, every backtest, every signal — fully open source. Clone and verify.

View Code on GitHub